A total of 97 have disclosed the ‘returns’ on their investments to Moneyweb – their losses exceed R35m, or an average of R363 917 per person.

The Cape Town-based contracts-for-difference (CFD) trading platform Banxso, sponsor of UFC champion Dricus du Plessis and Bafana Bafana, continues to benefit from fake ads in which well-known business leaders promote investment platforms promising outrageous monthly incomes for a R4 800 investment.

This follows Moneyweb breaking the story over two weeks ago that individuals who registered on the fake ads were immediately captured on the Banxso platform.

Read: Banxso – beneficiary or victim of ‘R4 800’ Musk and Rupert scams?

Banxso vehemently denies that it is linked to the fake ads and claims the matter resulted from a malicious cyber attack by an unknown third party trying to tarnish its reputation.

In a statement issued to Moneyweb, Banxso claims it has “thoroughly investigated” the cyber attack and filed a report with the Financial Sector Conduct Authority (FSCA).

Read:

FSCA warns against dubious brokers, platforms offering easy money

FSCA’s Immediate Matrix warning

It also states that “despite efforts, it is not feasible to prevent Immediate Matrix from placing leads directly onto Banxso’s platform due to the nature of online redirecting methods”.

This despite writing three cease-and-desist letters in mid-February 2024 to Immediate Matrix and Dynadot, a domain marketplace, threatening injunctive relief if the Banxso demands are not met.

The letters are available here. (One letter emanates from leading law firm ENS.)

The statement also expresses dismay at questions Moneyweb sent to Manuel de Andrade, Banxso’s general manager, regarding the issues addressed in this article, to which Banxso responded: “The inquiry into Banxso’s business model, including requests for detailed information on operational strategies, liquidity providers, and internal compensation structures, is inappropriate and exceeds the boundaries of reasonable journalistic curiosity. Banxso, as a private entity, maintains proprietary rights over its business operations and strategic decisions. Disclosure of such information is not obligatory and does not pertain to the public interest in the context of the allegations made.”

Oppenheimer ‘promises’ R34 000 a week on R4 800 investment

Despite its protests and claims of an inexplicable cyber attack by unknown perpetrators, Banxso continues to register clients who react to the fake ads.

Moneyweb came across a Facebook advertisement on 9 March purporting to be an SABC article. It states: “Nicky Oppenheimer, together with the South African government, launched a new project aimed at helping families become wealthier.”

The headline is “Nicky Oppenheimer’s Momentum Capital: A Game Changer for 140,000+ Investors, Generating Unprecedented Profits!”

The ad claims that Momentum Capital offers South Africans a weekly return of R34 300 on a once-off R4 800 investment in “cryptocurrency operations.” This represents a return of 615%.

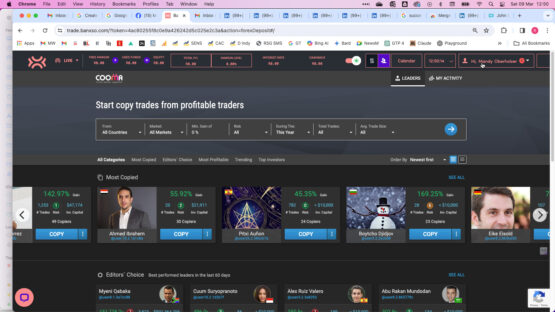

Moneyweb registered via the registration function on the page using a fake name, Mandy Oberholzer.

On submission, the page redirected to a trading account it proclaimed had already been opened on the Banxso platform.

Mandy also received an SMS and email immediately after the registration, with the email containing Mandy’s login.

Within less than a minute, a Banxso agent phoned Mandy to try to onboard her.

The agent denied any link between Banxso and the fake ad. It was not clear if Immediate Matrix was involved.

In response to questions regarding Mandy Oberholzer’s automatic registration, De Andrade replied: “The existence of these fake ads is against our interests, and we would stop them if we had the means. We have noticed unauthorised registrations on our platform. After investigating the “Mrs Oberholzer” registration linked to your phone number, we found that our sales team had clearly informed you that Banxso has no association with these ads. While your approach to testing our employees’ responses is noted, it doesn’t reflect our company’s practices or intentions.”

Interestingly, a few hours later, ‘Mandy’ was accosted by several other platforms through WhatsApp and phone calls from UK numbers.

These platforms were CM, CostaFX and Lbank fx.

All claimed Mandy had registered on their platforms.

Extensive investigation

Moneyweb’s first article revealed that Banxso benefitted from referrals by Immediate Matrix, one of the companies behind the fake ads.

After the article’s publication, Banxso offered refunds to people who reacted to the fake ads and made deposits.

In the statement, Banxso claims: “Fewer than 20 clients have come forward to date in response to offers of compensation relating to ads from Immediate Matrix. Banxso is prepared to entertain such claims.”

Victims have lost millions

Shortly after Moneyweb published its first Banxso article in February, more than 200 people contacted Moneyweb to complain about Banxso.

A total of 97 disclosed their losses, totalling R35.3 million, or R363 917.52 per person, on average.

Most individuals claimed they reacted to the fake ads.

Moneyweb also obtained 10 affidavits that victims have deposed under oath as part of criminal cases and complaints to the FSCA and the National Consumer Commission.

However, the most revealing information came from two former Banxso employees who spoke openly to Moneyweb about the inner workings of Banxso’s operations.

They spoke on condition of anonymity, but Moneyweb has verified their employment at the firm.

A third former employee, who also wanted to stay anonymous, provided detailed information corroborating his former colleagues’ versions of Banxso’s modus operandi.

All three allege that Banxso is aware of the origin of leads and that the company pays between $800 and $1 000 per lead if it leads to the successful onboarding of a client and the payment of a deposit. One even confirmed that Immediate Matrix is an affiliate.

De Andrade acknowledged that Banxso closely monitors leads. “However, when registrations lack a tracking pixel, pinpointing their origin is challenging. We are working on enhancing our tracking capabilities to prevent such issues.”

Manuel de Andrade, Banxso’s general manager. Image: Zoom call screengrab

Building a financial profile

Once onboarded, success managers enter the fray and engage the clients to convince them to make additional deposits.

They also start to build a client’s financial profile.

According to the former employees: “The success managers often ask for bank statements, and they build a financial profile on these clients.

“They Google their address and see via Google Maps if they live in a high-income area, what the house looks like, and to see if the client is ‘whale’ [rich individual] or not.”

The former employees also stated that some agents would convince clients to share their screens during a Zoom call and instruct them to log on to their online banking. “Once they can see the account balances, they take screenshots of your accounts and keep it on file.”

One of the victims confirmed this practice. In an affidavit that is part of a criminal case opened in Johannesburg, the victim states that a Banxso agent saw her investment portfolio at Netwealth during a Zoom meeting.

“On the Zoom call, Martin saw my JSE EXCEL spreadsheet. Due to short sellers, my investment was negative. He was “appalled” that Netwealth did not advise me better and that my account was negative.

“He assured me that he will make my investment grow by [a] minimum [of] 30%. I will get a monthly pension of about R30 000pm. I must sell all my shares and invest with them, and he will pay the cost of the selling. [He didn’t pay the cost.] I explained that it took me 20 years to save that money for my severely handicapped child … That money must sustain my son when I am not there to support him. He is severely handicapped and has the mind of a 1-year-old. Martin assured me that if I sold all my shares and closed my Nedbank account, he guaranteed better growth.”

The victim eventually lost R2.5 million.

Extraction of money

The former employees also stated that once a client is onboarded, a process starts to extract as much money from them as possible.

“In the beginning, they treat you properly. They will start with the $250 and do a trade that will give you a profit of $25. The agent says, ‘If you had $5,000, you would’ve made $500. Now, just put in a few extra thousand dollars for a week’ and they continue to do so until the client has, say, invested $25 000. Now they can smoke you,” one said.

“They made people refinance their houses, withdraw pensions and convinced them to take out loans,” the former success manager said.

“The goal is to lose the investors’ money. They were f*ng people up. There’s no nice way to say it.

“They’ll overexpose you through trades which will lose money. The client will try to protect it by depositing more money. We put them in a state of denial psychologically. Now, you’re in a state of denial. You believe that there’s hope you will come out of this. But there’s a pattern here that hope is hopeless.”

High swap fees

Many Banxso victims complained to Moneyweb about exorbitant swap or ‘rollover’ fees. These fees apply to CFD trades where the position is open for more than a day.

Several investors have sent Moneyweb trading statements, and in one case, an investor took an open position on a trade involving Nvidia for six days, and the swap fee amounted to R2.566 million.

Banxso said: “Banxso explains swap fees to clients as part of our commitment to transparency and education.”

Size of the scheme

Banxso refused to disclose the number of clients it has, although De Andrade claimed during previous interviews that it signed up “thousands” of clients a day.

However, the former employees believe the company signed up between 400 and 600 of the 2 000 leads it received per day.

Based on the experience of the former employees and the claims of De Andrade, if Banxso onboarded only 400 ‘investors’ a day for the past 12 months to allow for a ramp up of business following its launch in April 2022, the company may have around 180 000 customers.

The average deposit amount of the people who contacted Moneyweb was R405 000.

There is no indication of Banxso’s actual average deposit per client, but if it is as little as R50 000, many billions of rand may be caught up in the Banxso trading that was lost to clients and benefitted the company.

In comparison, the Tannenbaum Ponzi scheme attracted R12.5 billion and the Mirror Trading International (MTI) crypto scheme R15 billion.

Advertising campaign

Banxso booked an advertising campaign with Moneyweb before Moneyweb’s investigation found a link between the fake ads and Banxso. Moneyweb cancelled the campaign.

In the statement, Banxso expressed its “dismay” at a decision by Moneyweb to cancel the campaign, for which the platform paid in advance. “This action, devoid of prior dialogue or an attempt to understand our position, reflects a prejudgment that undermines the principles of fairness and due diligence expected in professional journalism.”

Banxso paid for the campaign upfront, and the money remains in the bank account of Moneyweb’s sales house, United Stations. Moneyweb has sought legal advice regarding the repayment, but has not received a letter of demand for the repayment.

* Moneyweb’s policy is to accept advertising only from FSCA-licensed businesses, which Banxso is. However, the new campaign was cancelled as a precaution based on the events described in this and the previous article.

Read:

Tips to avoid being scammed when investing in cryptocurrency

Here’s how the most advanced crypto scams work

We track down funds scammed from a Moneyweb reader

Any investors who have lost or made money on the Banxso platform are welcome to contact the editor at ryk@moneyweb.co.za.